PayPal is one of the leading online payments and banking service providers across the globe. But with Twitter rebranding to X, an everything app, Elon Musk’s former creation may face serious rivalry in the global market.

New CEO Linda Yaccarino recently reiterated Musk’s desire to turn X into a super app akin to China’s WeChat. Part of the features X will gain in future will revolve around payments and banking services.

At this point, it’s still unclear how X payments and banking services will work. But given we already know how X’s mentor (WeChat) operates, it should be an easy guess.

As things stand, X is a social media company. And in order to venture into the financial system, a number of things are required, among them proper licenses and software.

And indeed, FT reports that the X team has already started applying for payments licenses in the U.S. The company is also working on the necessary software required to introduce payments and banking on X.

X payments and banking facing tough U.S. competition

Once fully integrated, the X banking system will reportedly include peer-to-peer payments, savings accounts, and debit cards.

Sounds familiar? Well, it sure does. And it’s because there already exists other financial institutions providing these services to Americans.

Granted, X payments and banking services may not appeal much to Americans. They already have deep experience using credit cards regularly. If anything, they don’t need a super app to do the same things.

The country has many financial firms competing at every level — banking services, credit services, payment apps, stock brokerages, etc.

This means X will be entering a far more crowded and competitive market. Furthermore, the American market is already using much better and more developed financial alternatives.

Luckily, this is not true for all markets outside the U.S. — markets where PayPal has a significant foothold when it comes to cross-border peer-to-peer transactions.

WeChat model may not work in the U.S.

WeChat’s success was largely due to the popularity of Tencent’s QQ social networking app. Given X has 450 million users to work with, Musk is convinced he can convert most of them into active users of his financial services.

But as noted, Americans already have reliable financial services and don’t need another one. Furthermore, the likes of Meta and Alphabet have tried and basically failed at tempting them away from their current solutions.

Also, X is used more on mobile phones. And naturally, these banking and payments services will be expected to happen more on phones.

But unfortunately, mobile payments are not the most popular in the U.S. Although recent stats show that things may be changing for the better.

X payments can take on PayPal in global markets…

However, Musk and X may have a better chance at cracking the financial market by going global and not just focusing on the U.S. market.

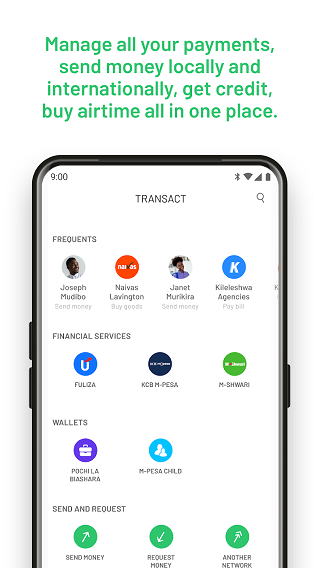

Sure, X may not have the biggest user base in these markets compared to the millions in the U.S. However, unlike the U.S., mobile payments are pretty much the go-to option in some untapped markets across Africa and Asia.

Here’s the thing. Just like how WeChat took advantage of the unbanked in China to propel its growth into a financial super app, X can take a similar route since most people in developing markets are still unbanked.

Countries are switching from cash-based economies. Today, most people in these regions have a cheap smartphone with some sort of app that they use to transact.

In fact, most people in developing nations don’t have a computer, but they have a mobile phone. Even better is that more are increasingly switching to cheap smartphones.

… But only if done right

But Musk will have to play his cards right in order to take on PayPal. One of the easiest ways for X to tap into this market is providing an online payment solution on platforms like Amazon.

Most people rely on PayPal and debit cards to pay for stuff on online stores. And this is where X payments and banking services can step in. With X on their phones, they can easily transact with vendors from across the world.

I think X (Twitter) payments/banking services can rival PayPal in Africa if done right. Make it possible to send & receive money from anywhere, pay for stuff on Amazon & co. Partner with local banks to allow withdrawing money from X to my local bank. Make it happen @elonmusk.

Source

With PayPal, people can receive payments and withdraw into hard cash through partnerships with local telcos and banks. X can also adopt this, letting users receive and withdraw money to local banks.

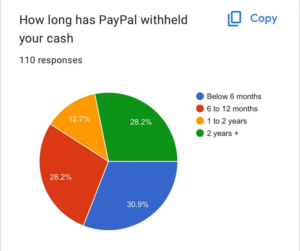

The major advantage is that X already has an active user base in the millions and disgruntled PayPal users to go with, so it shouldn’t be a problem getting off the ground.

Both PayPal and X have about the same number of active users. Granted, such a move by Musk would be a huge blow to PayPal, which, of course, is one of his first creations.

Let us know your thoughts in the comments and vote on the poll below.

PiunikaWeb started as purely an investigative tech journalism website with main focus on ‘breaking’ or ‘exclusive’ news. In no time, our stories got picked up by the likes of Forbes, Foxnews, Gizmodo, TechCrunch, Engadget, The Verge, Macrumors, and many others. Want to know more about us? Head here.