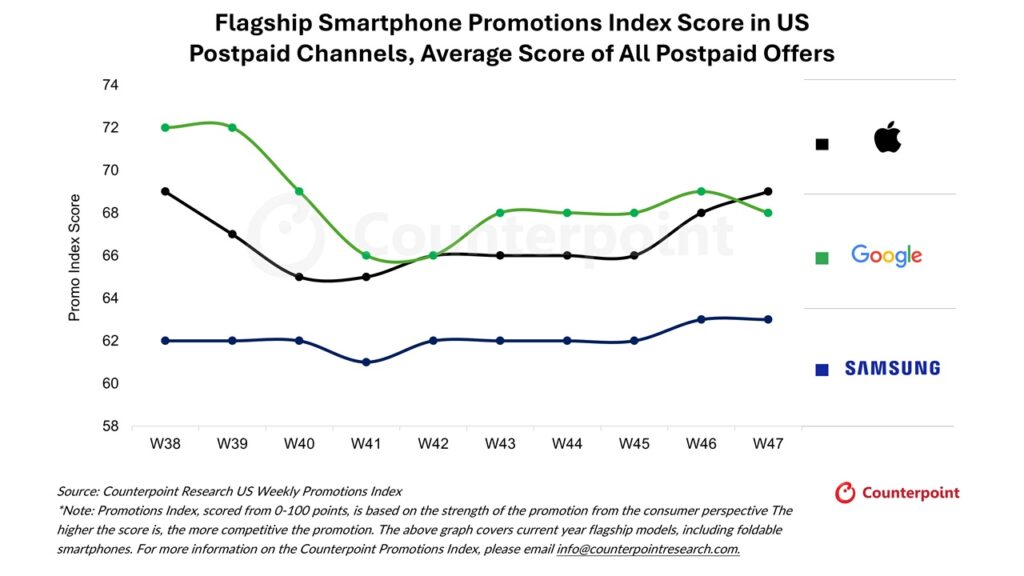

Google went into the 2025 holiday shopping season with serious momentum, and according to new data from Counterpoint Research, the company briefly managed to outmuscle every major smartphone brand in the US when it came to promotional value. But as Black Friday approached, Apple countered aggressively, ultimately edging out Google in sheer promotional “power” during the main shopping weekend.

The findings come from Counterpoint’s US Weekly Smartphone Promotions Index, which tracks device discounts, bundle deals, and operator incentives across postpaid, prepaid, and national retail channels.

Google kicked off the season early with huge Pixel 10 series promotions

With the Pixel 10 series continuing to build on its strong early sales this year, Google didn’t wait for Thanksgiving week to make a push. Instead, it launched some of its biggest-ever early holiday campaigns in late October and early November, successfully pulling ahead of Apple and Samsung in overall consumer promotional value.

Carrier support played a major role. Counterpoint notes that Verizon ran the most aggressive Pixel promos:

- Up to $1,260 off the Pixel 10 Pro Fold with no trade-in required.

- Pixel 10 Pro XL completely free on mid-tier (and above) unlimited plans.

- MVNOs, including US Mobile, selling the standard Pixel 10 for just $349 during the first week of November.

For Google, this early offensive was strategic. Black Friday deals continue moving earlier each year, and launching Pixel promos in October allowed the company to “beat the noise” of other holiday campaigns, something Apple has historically excelled at.

Apple responded with a last-minute promotional blitz

Google’s early lead didn’t go unanswered. As the holiday week approached, Apple dramatically ramped up its own ad spend and incentives, particularly on the iPhone 17 series. Notably, T-Mobile offered four free iPhone 17 units (no trade-in required) for switchers on the Essentials plan. Verizon, on the other hand, matched with its own aggressive iPhone 17 promos.

Samsung also held strong promotional positions, though more of its deals were tied to stricter trade-in requirements or higher-tier plans.

The late Apple surge was just enough to push Google out of the top spot during the Black Friday week itself, even though Google had led the weeks leading up to it.

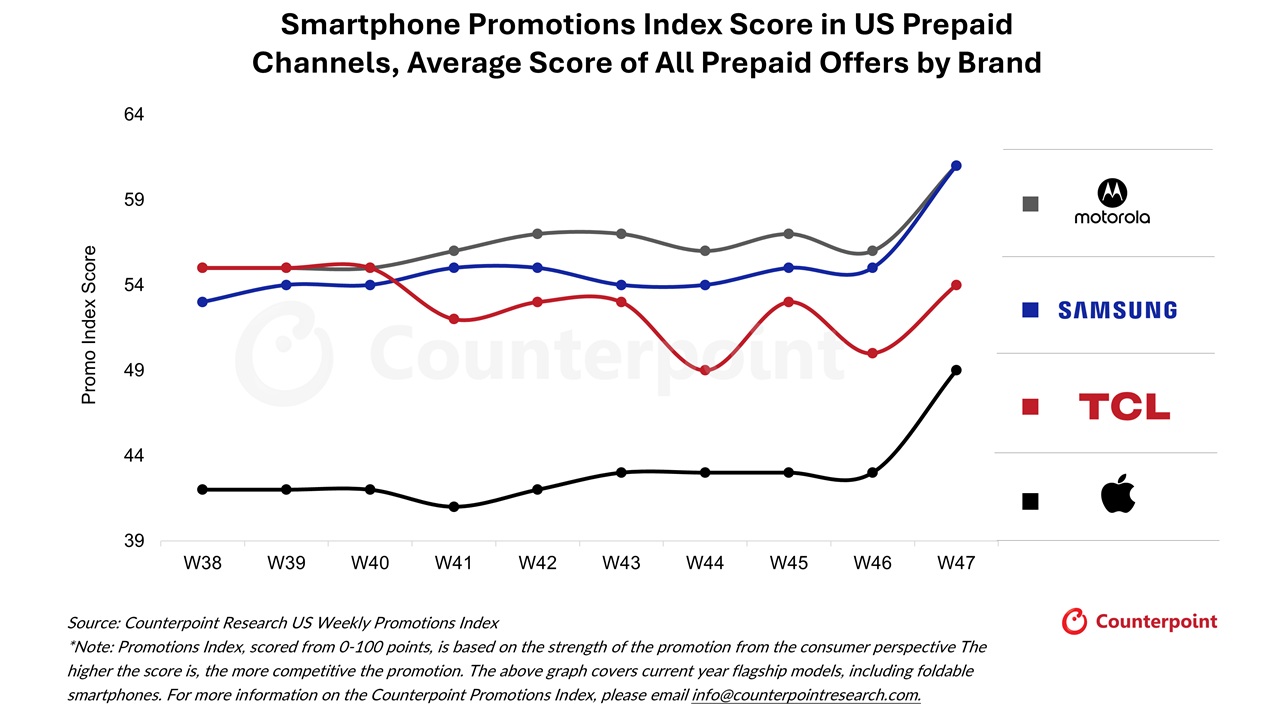

While Google dominated postpaid early promotions, prepaid dynamics were much more traditional. Counterpoint reports that:

- Motorola and Samsung tied for #1 in prepaid promotional value.

- TCL ranked third.

- Apple took the fourth spot.

- Metro by T-Mobile led prepaid promotional power across all OEMs.

Metro’s deals included a variety of “free” phone offers on mid-tier plans, from Moto G models to the Galaxy A16. The carrier even dipped into flagship territory, selling the Galaxy S25 for $250 with instant discounts on a $60 plan.

Ultimately, the analysis suggests that the US smartphone market is largely shielded from macroeconomic pressures, thanks to the overwhelming percentage of devices purchased via heavily subsidized 24-to-36-month EIPs. For Google, its early and aggressive Pixel campaign signals a strong commitment to maximizing sales of the Pixel 10 series and ensures a powerful competitive footing well into Q4 2025.