A Q2 2023 report by Canalys revealed that the Google Pixel doubled its market share in the U.S. compared to the same time last year. The search giant was also the only smartphone brand to record growth during this period in a market dominated by Apple, Samsung and Motorola. However, Google seems to be struggling to replicate this positive growth across the Atlantic, at least according to what I picked up from the latest report by Counterpoint Research.

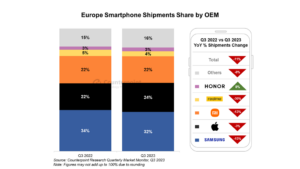

The ongoing economic and geopolitical challenges continue to be cited as the major reason Europe is seeing negative growth in smartphone shipments. Overall, the market saw an 11% YoY decline between Q2 2022 and Q3 2023, but Eastern Europe saw the worst decline of 15% due to the war in Ukraine. Western Europe still recorded an 8% decline, but this was a better outcome compared to 14% in Q2 2023.

Sure, the Pixel is more popular in Western Europe than Eastern Europe, although this is by no means to say Google’s phones had something to do with narrowing the gap in the former market. Still, there’s some considerable empirical evidence to suggest the Pixel might have actually had some hand in it, although don’t take my word for it. After all, I’m just a fan.

In fact, the new Google Pixel 8 and 8 Pro that came out in Q4 2023 will reflect in Q4 smartphone shipment stats. While the duo won’t suddenly double the Pixel market share in Europe, Google has doubled down on its marketing efforts to popularize the phones in the region. But going by the latest overall smartphone shipments, these efforts will take time to start paying off.

“Q3 2023 saw the lowest Q3 smartphone shipments since 2011,” Research Analyst Harshit Rastogi said when commenting on the market’s overall performance. “However, some OEMs have managed to gain a foothold in the market, such as Transsion brands TECNO and Infinix (particularly in Russia), while HONOR is doing well in Western Europe. Even as the market shares of top players remain the same, Chinese OEMs are switching ranks among themselves.”

It’s interesting to note that Xiaomi has previously faced backlash for its continued presence in Russia despite the country’s ongoing invasion in Ukraine. But despite this, Counterpoint Research says TECNO and Infinix gained a massive 192% and 518% respectively, with Russia emerging as their primary market. HONOR, previously of Huawei, also recorded significant growth to reach the top 5 brands in the region. The research further suggests that OPPO may soon become the first victim of HONOR’s resurgence, although other Chinese OEMs will unlikely be spared.

According to Associate Director Jan Stryjak, people holding onto their phones longer coupled with the tough economic conditions will see the smartphone market “remain muted for the foreseeable future.” People holding longer onto their phones makes Google’s 7-year support promise seem like a nail in their foot, but whether Google will feel the pain in future remains to be seen.

With the aggressive marketing of the latest Pixel 8 in Europe and even parts of Asia, Google seems to be backing itself as a future contender in the smartphone market in these markets. But even so, it will definitely take some time before it catches up with the big boys, who are also struggling to maintain steady growth in Europe.

You can check out the rest of the report on the Counterpoint Research website.