Building a good reputation with customers is no easy task. What took ages to build can come crumbling down in one go, which is close to what happened after the recent Square and Cash App outage.

Having spent over 14 years building a good reputation with customers, it only took Square about 14 hours to soil this sought-after trust.

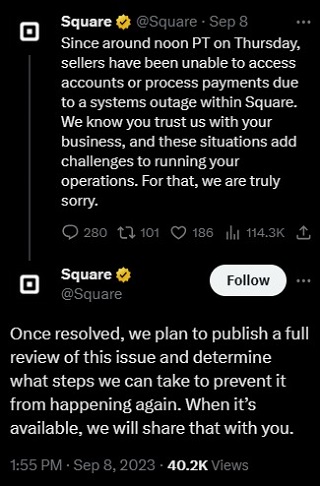

The outage began on the afternoon of September 7 and extended well into the following day’s morning. This left Square sellers unable to access their accounts or process payments.

It got even more interesting when reports of some Apple Pay and DoorDash users obtaining free money and food popped up. From the claims, it was pretty much evident the Square and Cash App outage was responsible for the glitch.

wassup with that apple pay and doordash glitch? all i see is people getting mad free food

Source

Apple Pay is only having issues because so many people are trying to take advantage of this Cash App glitch.

Source

Still, with so many small merchants depending on the platform, you’d understand the widespread frustration over how Square handled the situation.

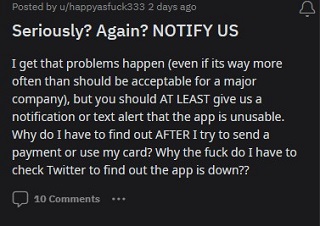

One notable complain that’s been doing rounds regards communication. While no system is immune to outages, Square merchants believe the company could have informed them rather than learn about it on social media.

For such a big company, it’s indeed true Square could have handled this situation better. Not everyone is on social media, so relying on such platforms to convey crucial information about outages doesn’t cut it.

A simple text or email would suffice, but Square chose otherwise. This, understandably, has been a source of frustration among affected users, who rightfully called out Square.

Major financial services suffer serious outage in US

A series of other US financial services went through the same fate. It all started with Square’s nation-wide outage, which also took down platform-dependent services such as Apple Pay and Cash App.

However, the situation took a massive turn when the outage hit other services unrelated to Square, among them Zelle and Venmo.

Talks of a potential cyber attack quickly escalated, prompting Square to issue a statement against these claims. But none of the other services came out publicly to deny or confirm the claims even after services were restored.

Lessons to learn from the Square & Cash App outage

The outage was a major embarrassment for Square. It also serves as a reminder of how fragile our digital financial systems are.

For a big company like like Square to experience such a massive outage, many will be concerned about what risks relying too heavily on digital payments pauses.

Conversely, its worth noting that the Square and Cash App outage was an isolated incident. Other digital payment providers such as PayPal haven’t experienced this in recent times.

Furthermore, the fact that Square was able to resolve the outage relatively quickly so that users could access to their accounts within 24 hours expressed great commitment towards mitigating such incidences.

But for a better future, here are some lessons I picked up from this financial services outage:

- A robust disaster recovery plan detailing how to quickly identify and resolve problems, as well as communicate the mitigation process with customers during an outage, is a must-have for any business.

- Regular testing of disaster recovery plans to ensure preparedness in the event of an outage. This way, businesses can rest assured the recovery plans actually work and that employees know how to implement them.

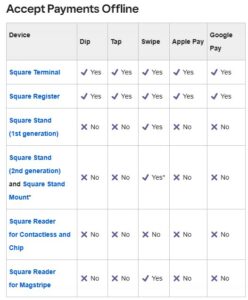

- Overreliance on digital payments is risky, so having a backup plan, preferably an offline payment system, can save your day in case you can’t access your digital account.

Square already taking steps against these types of issues

The good thing is that in a follow-up statement, Square has confirmed several improvements meant to handle such situations better in future.

A new set of firewall and DNS server changes to protect against the glitch and additional operational measures to limit risk of future outages have been deployed.

Square has also promised faster communication across all channels as well as expanded support for offline mode.

With this mode, you should continue accepting payments even in the middle of an outage, which is exactly what merchants needed during the recent outage.

It will be interesting to see how Square, Cash App and other digital financial services handle future outage incidences. But hopefully, this recent event serves as a warning to the unprepared.

Let us know your thoughts in the comments and poll below.

Featured image: Square

PiunikaWeb started as purely an investigative tech journalism website with main focus on ‘breaking’ or ‘exclusive’ news. In no time, our stories got picked up by the likes of Forbes, Foxnews, Gizmodo, TechCrunch, Engadget, The Verge, Macrumors, and many others. Want to know more about us? Head here.